Quicken 2017 For Mac Make Shorcut Key

Update: Please be aware the Quicken 2017 is only available for the US and Canada. Quicken has been around for many years and has become the go-to finance management software for the PC. Quicken's history with Apple products has not been as good however, with many of the features either missing, or not functioning as well as their PC counterpart. Microsoft word for mac, change theme colors.

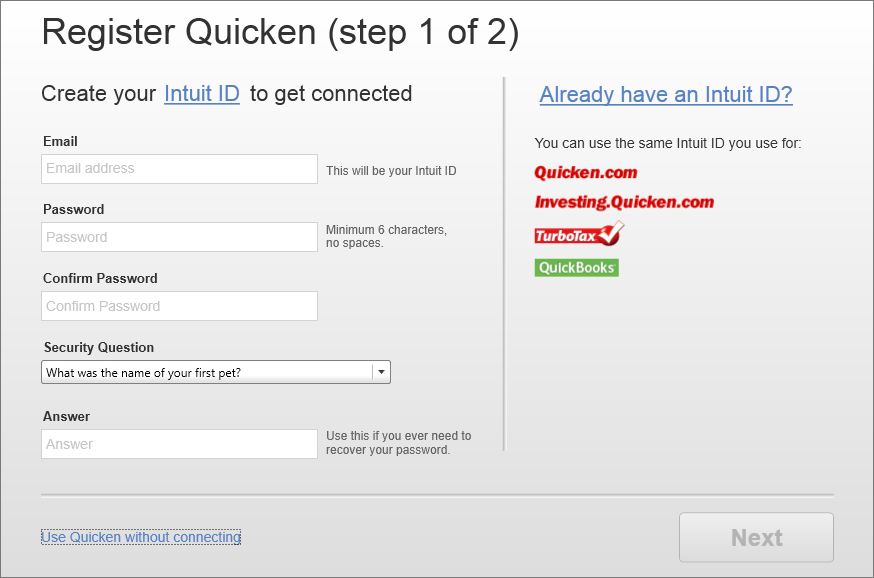

Quicken for Mac has seen some software improvements that brings it a lot closer to the PC version in terms of its feature set. In this screencast Todd Olthoff takes a look at some of the differences, and covers most of the features available in the 2017 version of Quicken for Mac. Quicken has some great features for tracking your bank and credit card accounts, as well as the ability to track your investments and loans to help you see your overall financial picture. We also take a look at Quicken for iOS, which allows you to see your financial picture on the go, and syncs with the desktop version. The full tutorial covers: • Mac vs PC Version • Installation & Set Up • Interface Overview • Add Credit Card Account • Importing Bank Files • Editing Account Details • Working with Transactions • Scheduling Transactions • Reconciling Your Accounts • Sorting and Searching Your Transactions • Working with Loans • Working with Investments • The Home Tab • Budgets Tab • Reports Tab • Calendars & Alerts Tabs • iOS Companion App App Store Links: Quicken 2017 for US - Quicken 2015/2016/2017 Money Management for US.

Is there a keyboard shortcut for 'mark as cleared'? Just as much pain as the drop-down to get to Mark As Cleared (on a mac).

I know, it's a bit crazy that this app is only designed for US/Can users, isn't it. As if the rest of the financially developed world doesn't exist, or they couldn't work out how to connect to our financial systems, so didn't bother. Or maybe we have decent software here already, and Quicken don't want to compete for potentially limited gain. AFAIR, they've always done this though (certainly in the last few years), by making their software US-centric only. But at least the guide here will help those subscribers.

Great overview of the Quicken application. My questions might be more of a 'How To' that should go to Quicken but I will ask you in case you do an update. In a budget, how do you show when you move money between accounts e.g savings into checking, and not have it show up in reports as Income?

If I pay an annual bill in August of $1200, how do I show in the budget that I set aside $100 each month for that bill e.g.

Can I easily make two or more separate budgets that then can be combined later for a report showing all? Thanks for the comment and questions! I'll see if I can answer this in a way that would help. Transfers as a category do not show as income. So when you move money from one account to another it doesn't show as an income source in the reports. You would budget out $100 for that category and it would accumulate income and roll it to the next month.

If you paid it before you had the money in there it would show negative but as you add the money in there monthly it would go down to zero. You can create multiple budgets but there is no way to combine them into a report at this point.

Hopefully that helps! Thanks so much for watching!